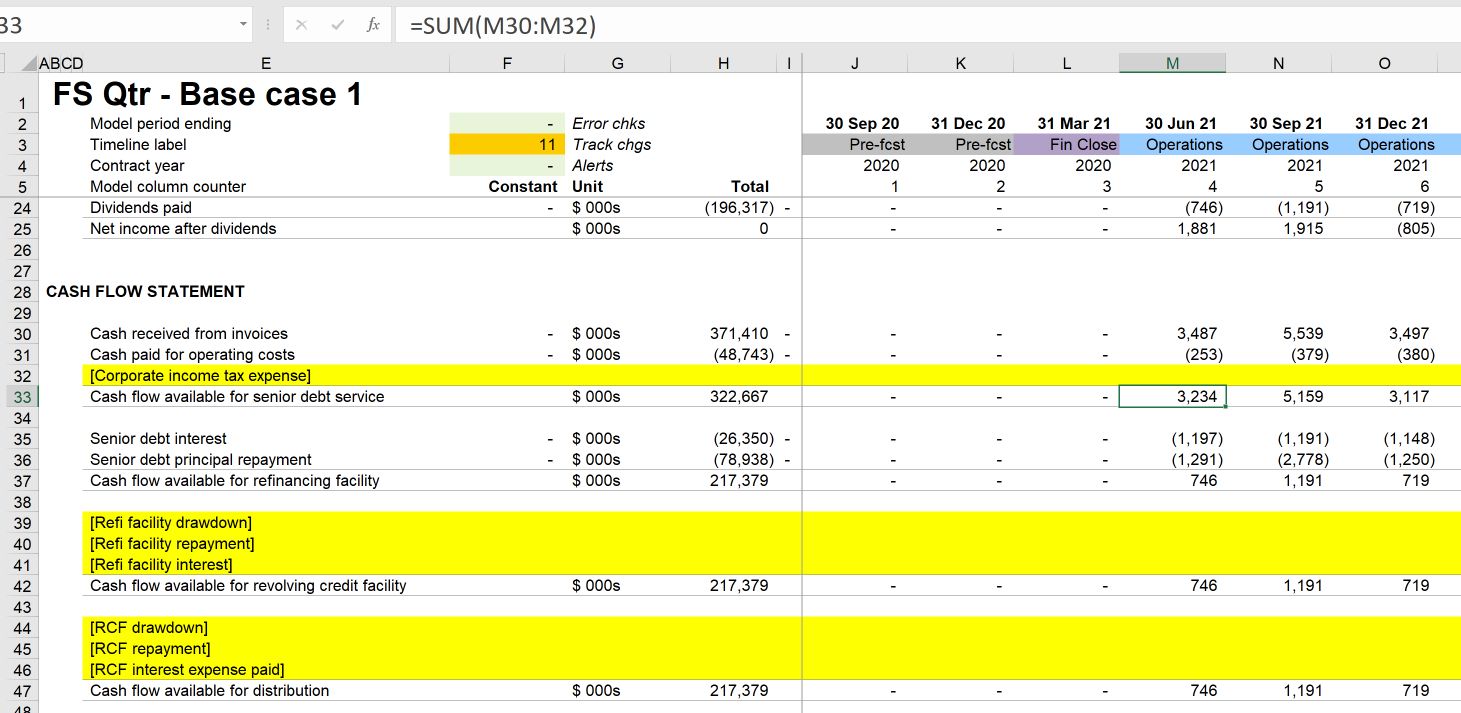

Dealing with our first period cash shortfall

Uncovering problems like this are why we build models.

Once we see how different parts of the business - revenue profile, working capital, and debt repayment- interact, we will identify problems that we could not have predicted.

We can then use the model to find solutions.

The problem here is that we only receive one month's revenue in the first operating period. This means that there is insufficient cash to meet our minimum 1.3x DSCR.

The two approaches to this are given by the definition of the ratio; we could either:

- Increase the cash available to pay debt; or

- Decrease the debt service.

Decreasing the debt service would require reducing the amount of debt. This would be damage to shareholder economics. And as the problem is only present in the first period, the most efficient solution would be to increase the cash available in that period.

Options to increase the cash available to pay debt

Assuming that the power tariff is fixed, there are still a few things we could do to increase cash available in the first period:

- Set up a working capital reserve, funded by debt. A reserve account set up before the first operating period would then release cash to make up the first-period shortfall.

- Obtain a working capital facility. Often project companies like this will obtain a working capital debt facility that they can draw down to make up for shortfalls like this one.

- Negotiate better payment terms. To test this in the model, reduce the accounts receivable days to 30 days. This would solve our cash shortfall problem:

The latter solution is also beneficial for overall project economics, as we can see from our increased IRR.

I cover working capital reserve accounts and facilities in my teaching on Project Finance.

For the moment, let's assume that the project sponsors have been able to negotiate those improved working capital terms and keep our 30 days accounts receivable assumption in our model.

Our 20+% IRR is about to take a serious hit, as we turn now to tax.

Comments

Sign in or become a Financial Modelling Handbook member to join the conversation.

Just enter your email below to get a log in link.