Fixed asset & 100% equity financing - solution

Hopefully, as soon as you knew you were dealing with balance sheet items, you already knew you would be dealing with new corkscrews.

Here's the walkthrough.

Download the solution file for this lesson:

To obtain the worked example file to accompany this chapter buy the financial modelling handbook.

Step 1: Set up a new sheet

We need a new sheet for the calculations related to our Fixed assets.

Copy the Template sheet using Skill 9: How to create a new sheet.

I have called the asset "Asset" - you may want to choose a different label.

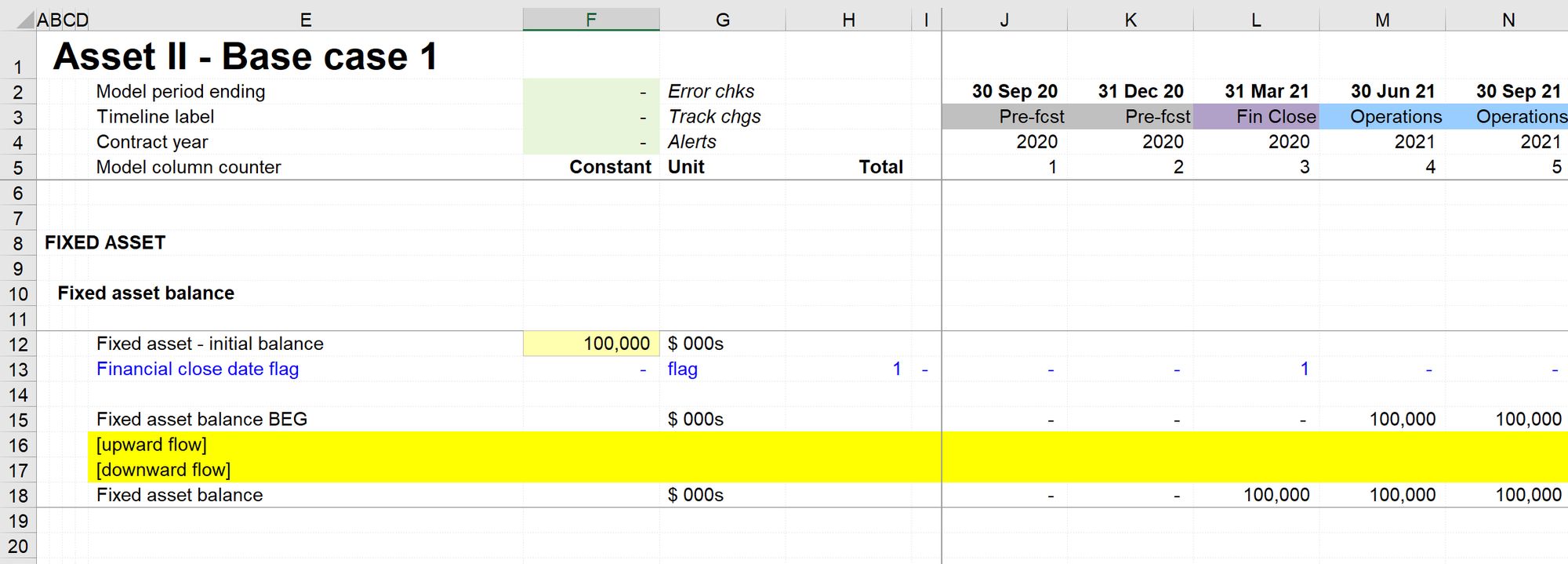

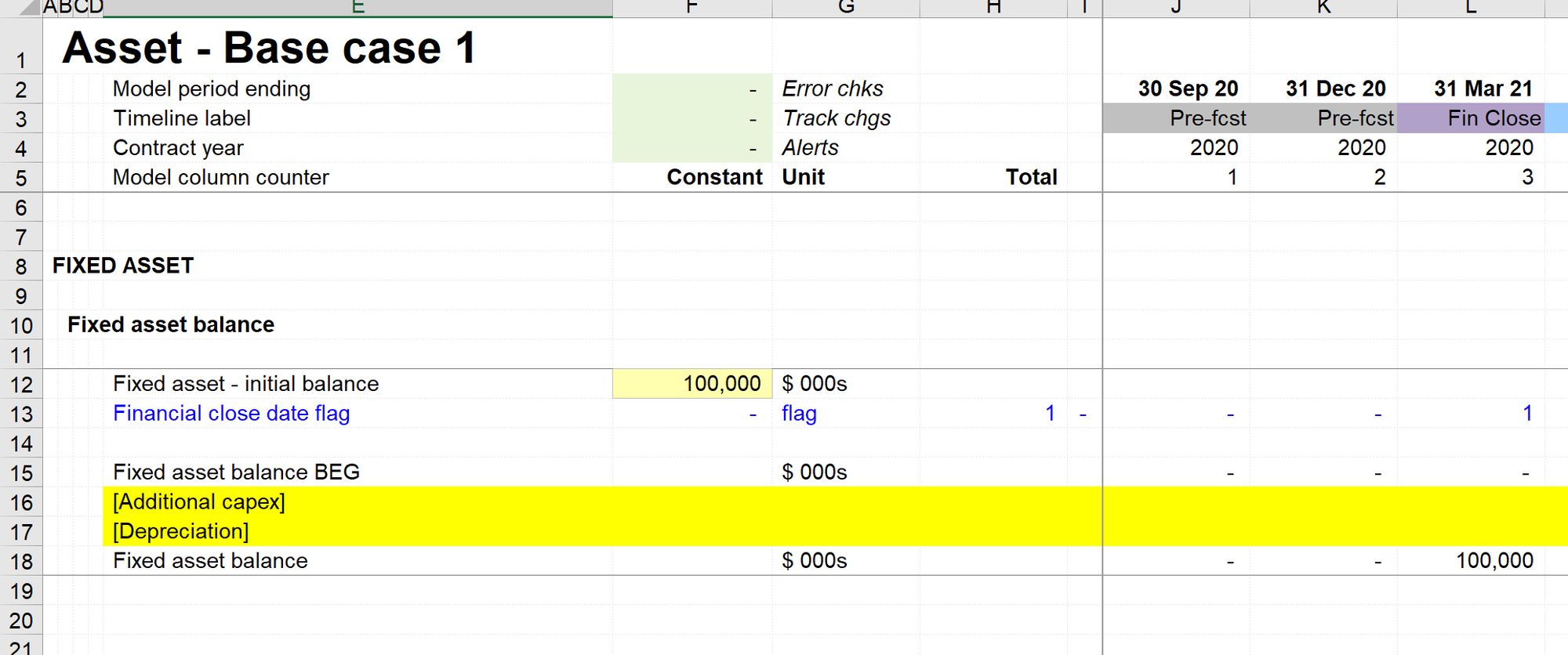

Step 2: Set up Fixed asset corkscrew

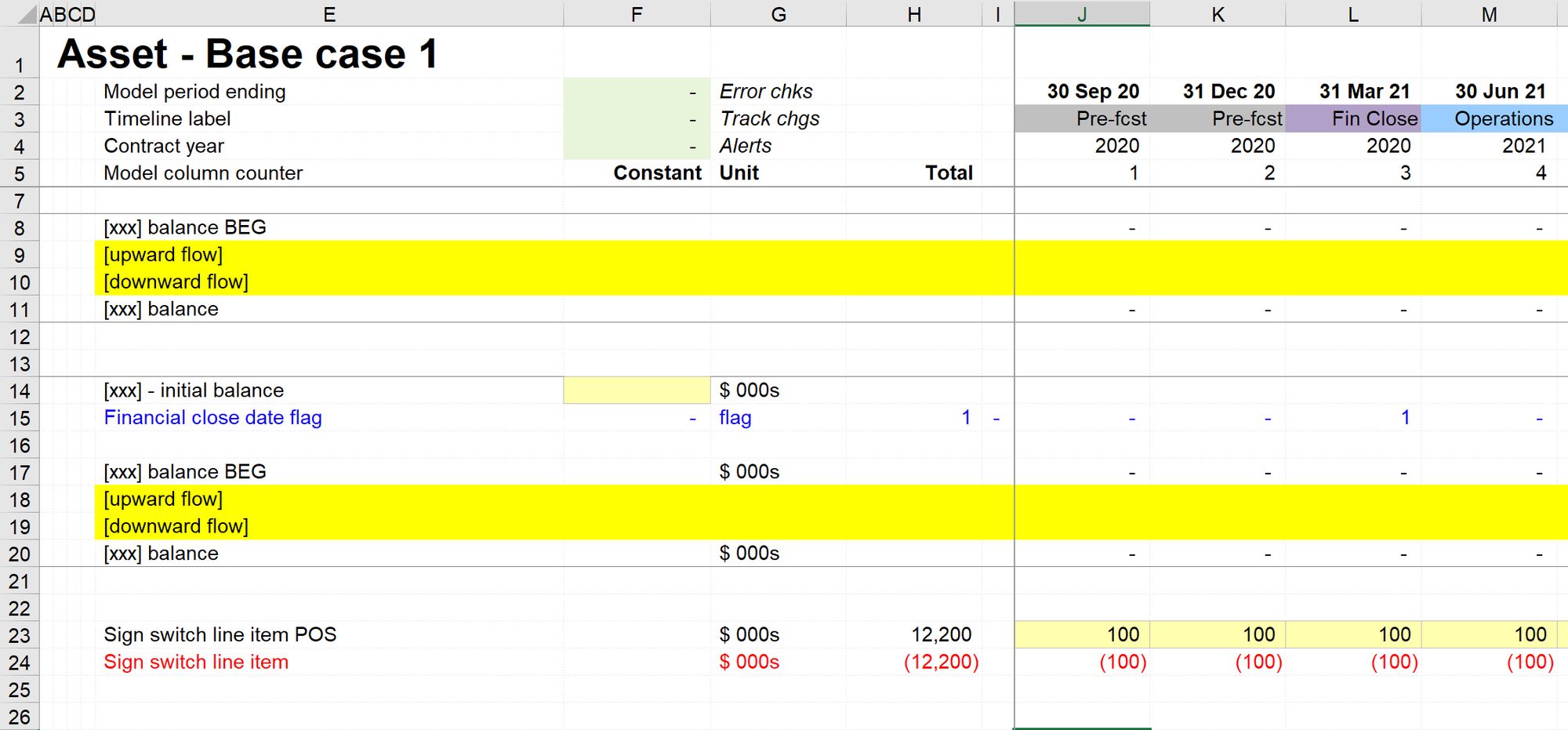

When we copy the Tmp sheet, we get a couple of free corkscrews. All we need to do to get this setup therefore is:

- Delete the 4 line corkscrew (we need the 7 line version as we have an initial balance to inject)

- Rename the labels. Use Ctrl+h to search and replace on [xxx].

- Add our initial balance of $100m

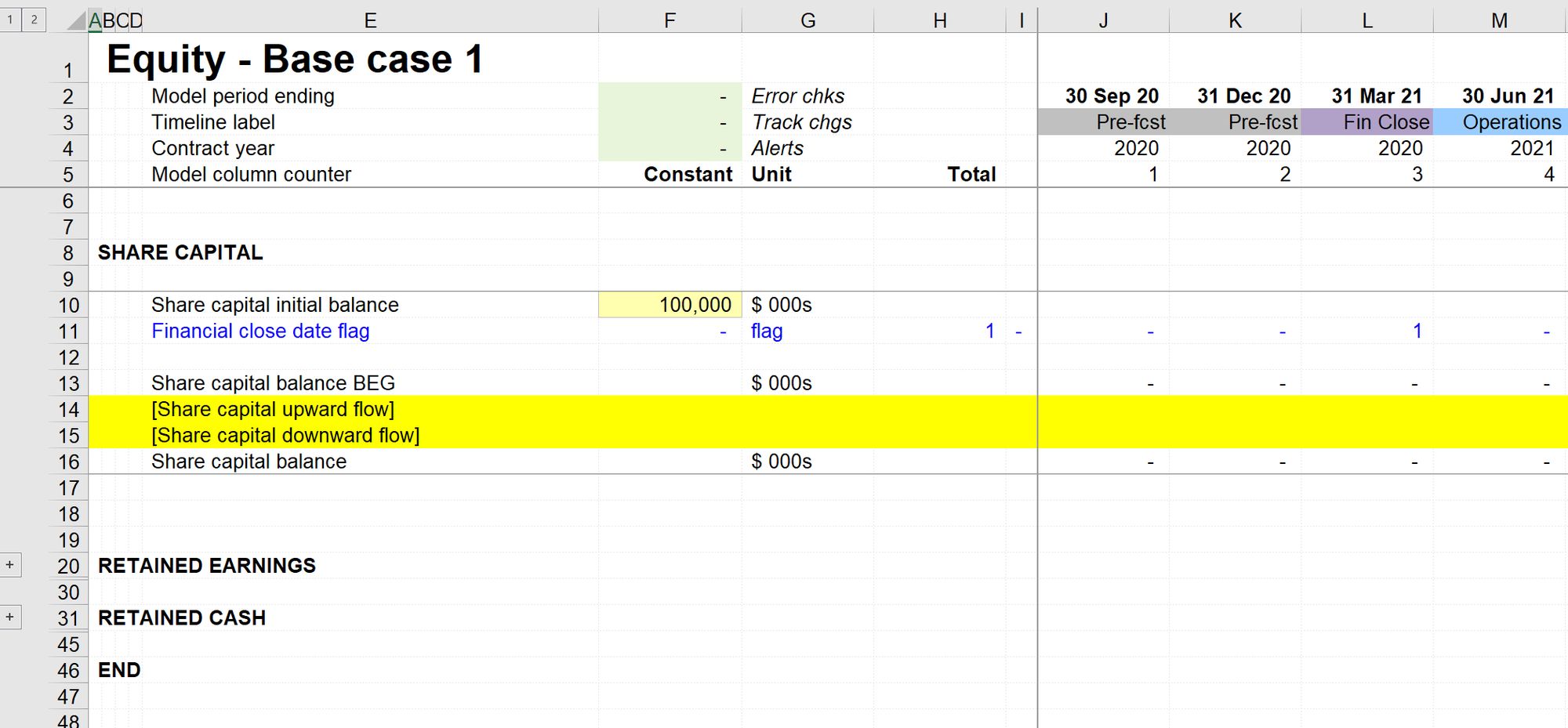

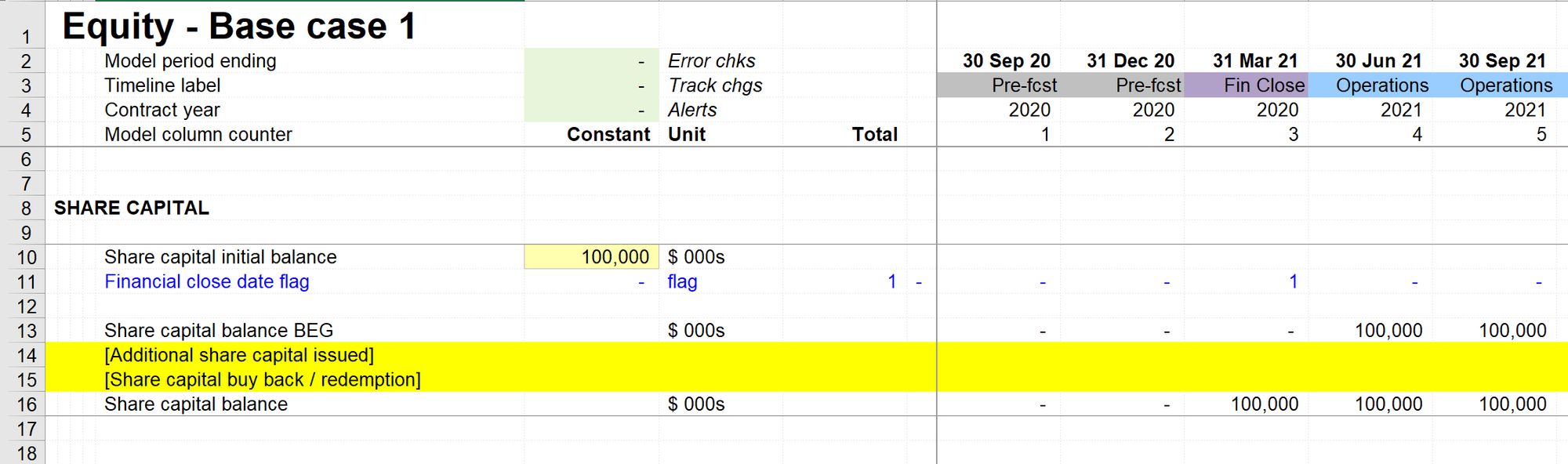

Step 3: Set up Share capital corkscrew

We will add our share capital corkscrew on the equity sheet.

First, create space and a section heading, then add the new corkscrew using Skill 8: How to create a new balance corkscrew.

We'll add our $100m initial balance as we did with Fixed assets.

Step 4: Rename the flows.

At this stage, we are not going to model the flows, but it's helpful to rename the placeholders so that we know what's going to go in there.

Fixed asset corkscrew:

- Upward flow: Additional capex

Download flow: Depreciation (could also be asset retirement or disposals in other contexts

Share capital corkscrew:

- Upward flow: Additional share capital issued

- Downward flow - Share capital buyback / redemption

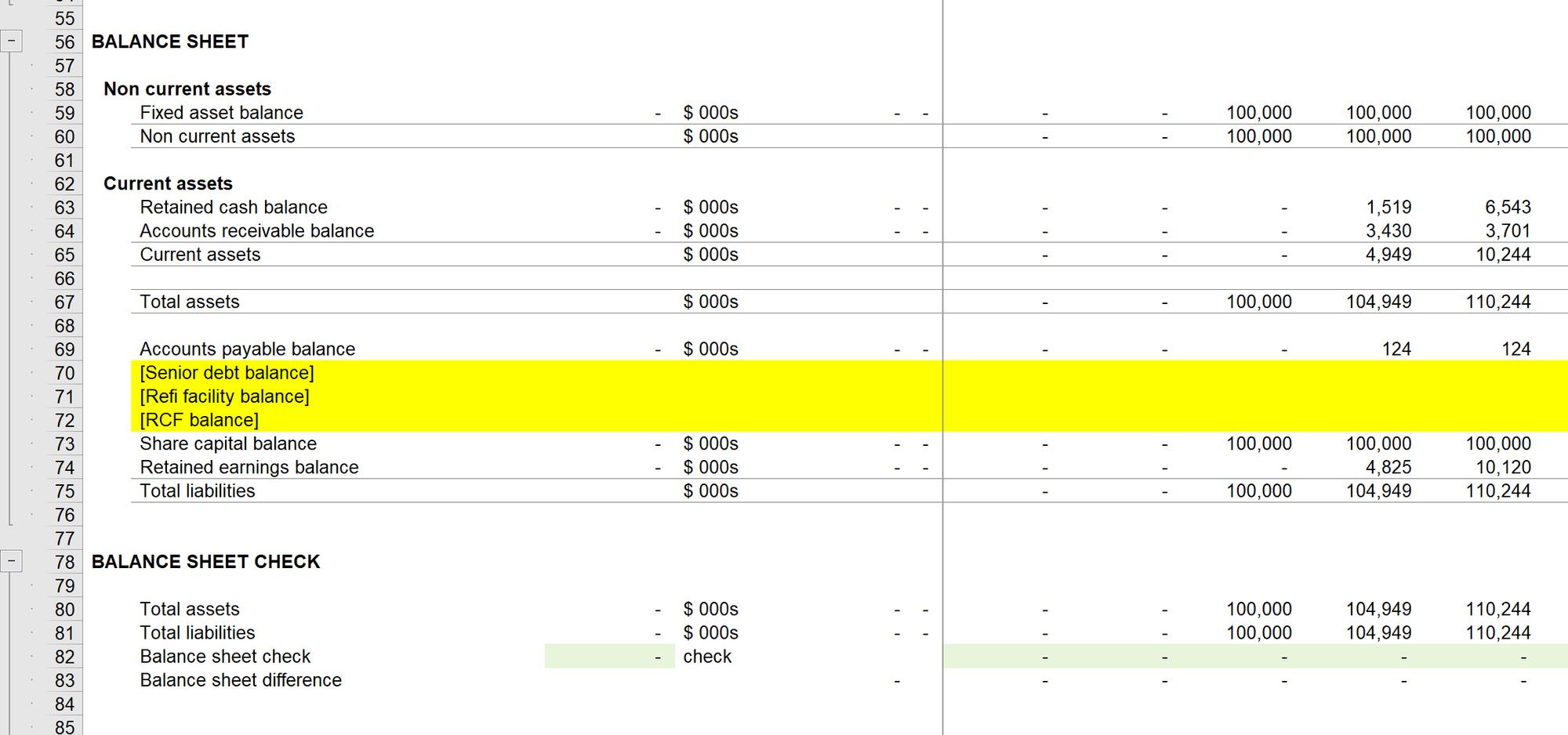

Step 5: Add the balances to the balance sheet

Using skill 2: How to create a link.

Since we are adding $100m to both sides of the balance sheet, the balance sheet continues to balance.

As usual, run through the Section Completion Checklist before moving on.

Download the model complete to this point:

To obtain the worked example file to accompany this chapter buy the financial modelling handbook.

Comments

Sign in or become a Financial Modelling Handbook member to join the conversation.

Just enter your email below to get a log in link.